As with most things, industry buzzwords and phrases get interpreted to suit the author’s intention. Best case is this can be confusing and frustrating, worse case it can be misleading. I have been struggling with what term best describes those technologies that, when brought together, will deliver the consumer safe, reliable electricity that, for them, is hassle-free, and has the lowest impact on the environment at a reasonable price. These technologies may generate electricity, or they may help conserve energy. I have heard people talk about CleanTech, Demand Side Management, even GreenTech. So for the purpose of clarity, I will be using the term CleanTech.

When I reflect on the conversations I have with industry peers, analysts and solution providers it appears that most Utilities continue to be fragmented and a little unsure as to their CleanTech strategy. Different parts of an organization will likely talk about technologies related to their area of responsibility. Such as distributed generation and storage, microgrids, electric vehicles, or the various forms of demand response systems and advanced metering infrastructure technologies targeting different customer segments. Rarely will a Utility clearly articulate a joined up strategy that describes its value proposition as to why it is in the CleanTech space.

My observations are the same regardless of whether it is an integrated Utility, a generator, a network business, a gentailer, a retailer, or any other market participant that will exist depending on the regulatory model in your part of the world.

The Utility business model has been the same for decades. With the disruption of the traditional Utility business model at different stages depending where you are in the world, many Utilities are stuck in that ‘Kodak moment’. Utilities know disruption is on the way, but profits are still stable from the existing business model. New models may not yet make money for them and may eat into core revenues. In some cases, certain Utilities don’t believe disruption can or will happen in their market anytime soon. So many continue to run pilots but don’t develop an overall CleanTech strategy.

I am not suggesting any Utility has adopted the wrong strategy. I am also not suggesting there is a single strategy that all Utilities should adopt.

What I am suggesting is that Utilities need to take a more holistic view of the future electricity supply and demand landscape. So they can make an informed decision and answer the questions, do they want to play in some or all of the new emerging markets? If yes, which parts and when? What role do they want to play and what are their objectives? Once they answer these questions they can develop a joined up strategy to work out how they will do it. The strategy is to be a living document that is regularly revisited.

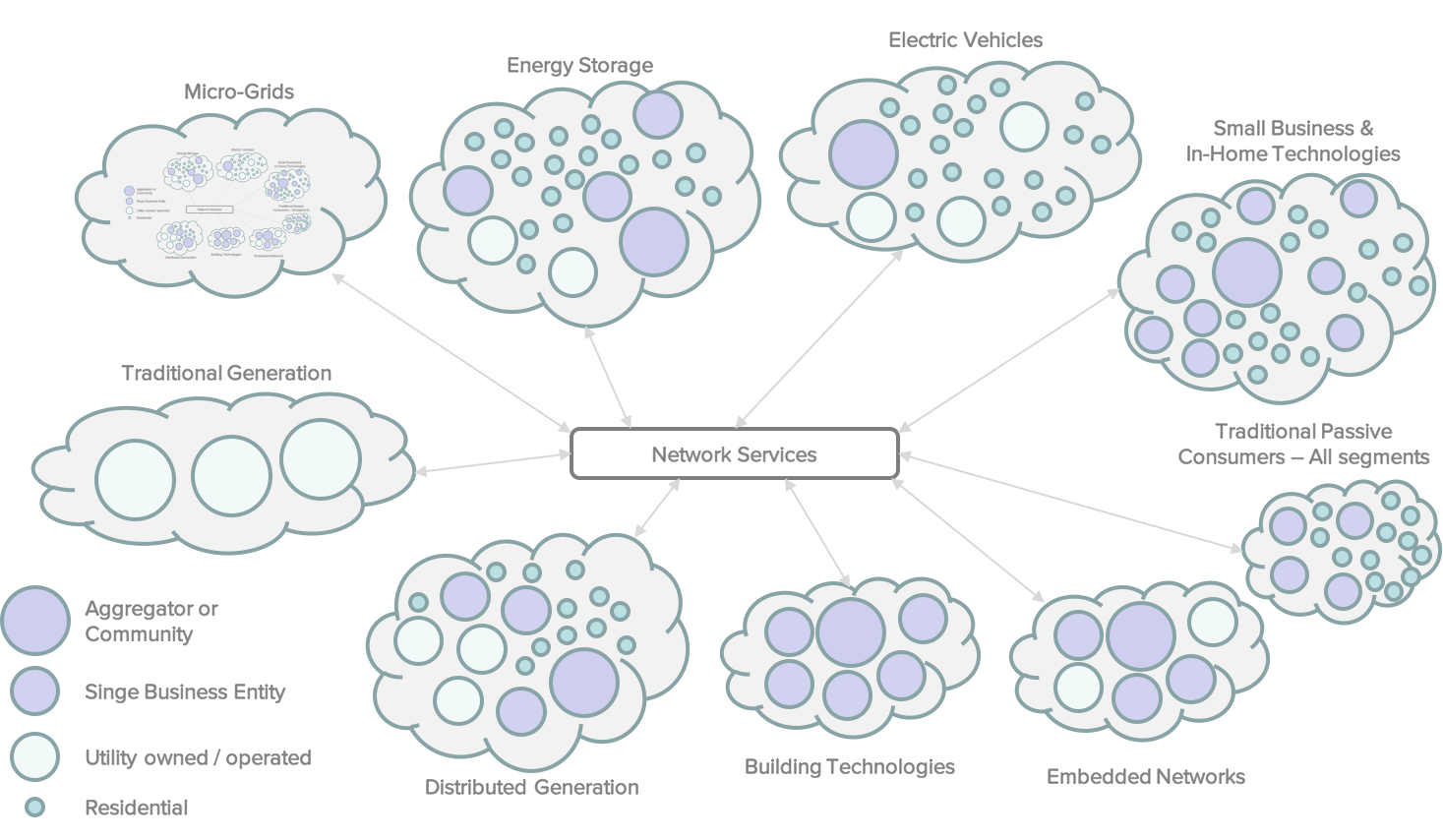

In figure I, I have attempted to illustrate an ‘overly-simplified’ view of the future supply and demand landscape. The point here is that a Utility’s future landscape will include all of these ‘markets’ to some extent. The key for each Utility is in determining what role, if any, they may want to play. The decision not to enter a particular market is not a wrong decision, so long as it is an informed one and reviewed regularly.

The Utility just needs to remember that they are no longer alone. GAFA, telcos, upstream players such as oil companies, traditional utility equipment suppliers, building manufacturers, and niche players are all looking at these same emerging markets and are also thinking if, where and when they may want to enter. Many of them are years ahead of Utilities in terms of their ability to gain insights from data; design and market new products and services, and drive great customer experience. So a Utility waiting for a market to emerge and then react may be too late.

Figure I: Illustration of the future landscape of electricity supply and demand

For example. Utilities that manage networks are often fearful of the growth of microgrids as they may erode core business. As the name states, a microgrid is just a small grid. Demand and supply still need to be balanced. Safety, reliability and cost remain paramount. Customers need to be engaged and billed. If there are many microgrids then economies of scale become important. I can only see this as an opportunity to Utilities. If someone else can deliver a microgrid better and at a lower cost as compared to a network Utility, then questions should be asked. After all managing a network is their core business.

Another example is Demand Response, which is a critical service that joins up all of the areas described in Figure I. This is such an important area that, in the coming weeks, I will provide a series of posts to dive deeper to help build a strategy. Hopefully, those posts will help you see why a Utility should not look at clean technology investments in silos. Demand response is a core component of a CleanTech strategy and must factor in distributed generation, distributed storage, electric vehicles and electric vehicle charging stations, building management systems of large commercial and industrial consumers, and the in-home technologies emerging in the small to medium business and residential customer sectors.

Underpinning all of these clean technologies is the need to know what amount of electricity is being generated, consumed, and stored, and when. Knowing this will allow you to satisfy customer needs in the most cost-effective and environmentally friendly way. This means advanced metering infrastructure is also part of a CleanTech strategy.

I appreciate for many of you, business priorities, organisational structures, internal capabilities, and for that matter external capabilities make it is easier to look at many of these in silos.

So next time someone in your organization talks about CleanTech. Whether that be microgrids, distributed generation, distributed storage, embedded networks, demand response management systems, advanced metering infrastructure, electric vehicles and charging infrastructure, or in-home technologies. Ask the question “is this part of a joined up strategy that has a clearly defined value proposition?”.